Optical Module Procurement Guide – Mastering Price Trends and Strategic Buying

Understanding the cost of optical modules has become a formidable challenge for IT and procurement professionals. Vendor proliferation, rapid technology advancement, and shifting demand make for an uncertain pricing environment. This paper is designed to help you decipher price trends, evaluate suppliers in a sophisticated manner, and apply effective procurement strategies. By understanding these concepts, the reader will be more adept at optimizing their optical module spending—spending less where possible while retaining the quality and reliability of the optical transport network. This paper illuminates tactical considerations to navigate one of the most dynamic segments of network infrastructure procurement.

What Drives Optical Module Prices? A Breakdown of Core Factors

The Fundamental Cost Drivers

The prices of optical modules are greatly influenced by several major factors, which are as follows. First, a significant share of the total cost comes from raw materials, such as lasers, silicon chips, and specialty semiconductors. Then, the cost of precision manufacturing, which entails very complex procedures performed in a cleanroom environment, often with rigorously controlled quality standards. Additionally, the costs of research and development (R&D) are reflected in the total price, since vendors are constantly innovating to enhance speed, power efficiency, and reliability.

Next, all costs related to supply chain logistics (for example, the price of shipping and receiving freight) can impact overall prices. The availability of critical components could change and cause costs to be under upward pressure if supply chains or manufacturing have been disrupted. Finally, modules utilizing the newest technology will simply have higher cost premiums because of the specialized materials and engineering work involved.

The Impact of Technology and Market Demand

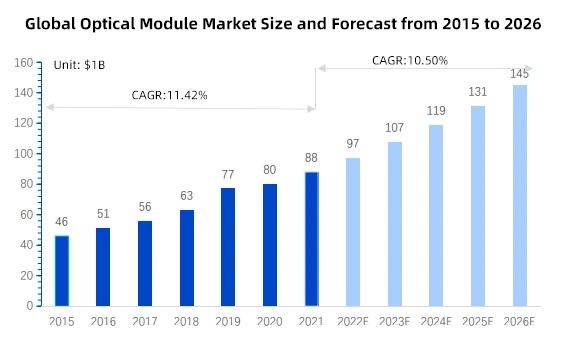

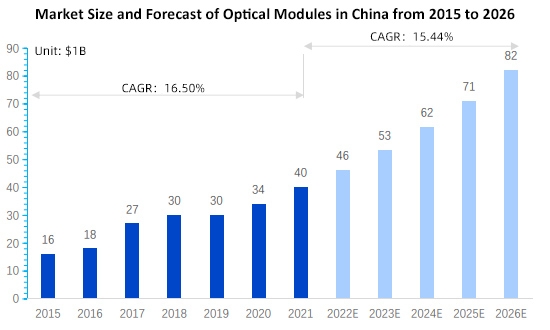

Shifts in pricing for optical modules will continue to be the result of technology advancements and changing market needs. The shift to higher-speed technologies (e.g., 100G or above) adds complexity in production, and a gradual price increase is expected during the adoption phase. However, compliant optical modules under a mature standard will typically have the benefit of the cost efficiencies associated with a production scale and should remain stable or decline in price over time.

Demand surges—often related to data center growth or network upgrades—can create temporary shortages with subsequent price increases due to imbalance. Global factors, such as shortages of chips or other geopolitical factors, can also contribute to volatility in pricing. Legacy optical modules may see pricing fluctuations correlated to their relevance and inventory levels in distribution channels.

The OEM vs. Aftermarket Price Divide: Why the Gap Exists

Comprehensive Brand and Price-Performance Comparison

| Brand | Model | Price Range (USD) | Max Reach | Power Consumption | Warranty (Years) | Typical Use Case | Notes |

| Cisco | SFP-10G-LR | $300 – $400 | 10 km | ~1.5 W | 3 | Enterprise core and aggregation | Highest brand premium |

| Juniper | EX-SFP-10GE-LR | $280 – $380 | 10 km | ~1.5 W | 3 | Enterprise networks | High compatibility, reliable |

| Arista | SFP-10G-LR | $270 – $370 | 10 km | ~1.5 W | 3 | Data center interconnect | OEM alternative, solid value |

| Finisar | FTLX1471D3BCL | $250 – $350 | 10 km | ~1.5 W | 3 | High-performance general use | OEM optical module supplier |

| FS.com | SFP-10G-LR | $120 – $180 | 10 km | ~1.5 W | 1-2 | Cost-sensitive deployments | Certified, great value |

| ProLabs | PL-10GLR-D | $130 – $190 | 10 km | ~1.6 W | 1-2 | OEM replacement, budget option | Tested, reliable aftermarket |

Why Major Brands Like Cisco and Juniper Command Higher Prices

Major brands like Cisco and Juniper charge premium prices mainly because of the brand name and rigorous quality control. These manufacturers invest heavily in R&D to innovate and enhance their optical modules, ensuring quality performance and reliability. Additionally, the extensive support infrastructure and warranties offered by OEMs provide added peace of mind and ultimately help to mitigate risk over the long term.

All of these factors make their upfront cost higher but could also decrease the total cost of ownership because of decreased maintenance and downtime. Think of OEM optical modules as akin to luxury vehicles. They are designed with superior engineering, backed by extensive service networks, and certified to ensure adherence to strict industry standards and reliability. Their level of consistency and compatibility reduces integration issues and establishes the expected behavior of the network with predictability, which is very important for enterprise-grade deployments.

Evaluating Aftermarket Modules: How to Find Quality and Value

The lower upfront cost of aftermarket modules is mostly what makes them appealing, but selecting the right one requires due diligence. Evaluating aftermarket modules means looking for independent lab testing certifications, indicating compliance with industry standards and performance levels. Extended warranties and a clear vendor history also show confidence and reliability on the part of the supplier.

Think of these aftermarket products as refurbished but certified electronics—if purchased from a reputable vendor, they will have very similar performance levels to the OEM modules, but at significant savings. Of course, there is also some risk involved here, such as a lack of compatibility or a shorter lifespan. A practical evaluation process includes:

- Reviewing compatibility with the existing network equipment.

- Reviewing performance reports, test results, and specification sheets.

- Reviewing warranty and support options.

A Strategic Guide to Optimizing Your Optical Module Spend

A Strategic Guide to Optimizing Your Optical Module Spend

Your Step-by-Step Procurement Strategy

The optimization of the optical module spend begins with proper demand forecasting to understand your network’s bandwidth requirements and future needs to avoid purchasing excess components or last-minute inventory purchases at inflated prices. It is important to break down the anticipated growth into specific phases, which will lead to an easier purchasing plan.

Additionally, negotiating for volume discounts with your suppliers can create substantial savings. When the purchase is larger, the bargaining leverage with your supplier is increased, leading to a better price or warranty; therefore, build a relationship with a supplier for the long term to establish trust and priority access to stock during supply chain shortages. Select vendors who provide a reliable product and responsive customer support.

In addition to bulk purchasing the module itself, negotiate on ancillary items such as breakout cables or transceiver adapters to further reduce spend. Compatible modules sold as a bundle can create savings and reduce logistics to the installers. Synchronize the new purchase months yearly with the vendor release of new products to take full advantage of any residual or legacy module movement to drive prices down.

Exclusive Data: Comparative Price Analysis and Cost-Benefit Tradeoffs

Market research demonstrates significant price differences between leading Original Equipment Manufacturer brands, such as Cisco and Juniper, compared to aftermarket brands. For example, Cisco SFP modules typically have a price premium of 20–40% over aftermarket brands that we consider reliable. OEM typically have a longer warranty period and enhanced support, thus with less potential downtime while changing out your modules.

Total Cost of Ownership (TCO) varies by module. If you include the risk, the warranty period, and how easy it is to replace or support based on the price of the module, there may be an argument for a higher expenditure upfront or alternative cost-effective aftermarket solutions. Based on the most recent data we assembled, we included manufacturer prices, cost, warranty period, and end-user input reflecting reliability assessment, and share the detailed comparison of potentially significant price and value differences.

Exclusive Interview: Industry Expert Insights

An expert in network procurement points to the value of buying optical modules at the right time. “Planning your needs six to twelve months out,” said the expert, “can help your organization negotiate better with vendors and avoid the excess cost of emergency purchases.” The expert also mentioned the importance of proper vendor assessment: “Select vendors that can provide testing and certification on their products to back up their claims of quality, and also have responsive pre- and post-sales service.”

When asked about balancing brand loyalty with purchases driven by cost-saving practices, the expert said, “A blended approach is often the best option. Where network reliability is concerned, work with respected OEMs. In deals that are less critical, and where savings and flexibility are necessary, vetted aftermarket modules can be reasonable.”

Avoiding Common Procurement Pitfalls

The 3 Biggest Mistakes and How to Avoid Them

When it comes to buying optical modules, there are a few common traps that can severely undermine the value of the investment and the reliability of the network. By knowing about these and preparing accordingly, you can avoid a potentially expensive mistake.

Mistake 1: Missing Compatibility

If you don’t determine if an optical module is fully compatible with your existing hardware, the consequence can be a failure to connect or performance degradation. Compatibility is not limited to the physical fit of a module. It also includes things like firmware versions, vendor certification, and protocol compatibility.

Before you commit to a new optical module, always make sure to reference any compatibility lists provided by the vendor, and verify the firmware on your hardware supports the optical module you are purchasing. Think of it this way: before putting together a piece of machinery, you would check to make sure the parts you purchased fit together correctly. Otherwise, you may find it does not work as expected for the purpose you intended.

Mistake 2: Missing Total Cost of Ownership (TCO)

If you only consider the purchase price, you risk not fully accounting for any hidden expenses associated with a failure, warranty claim, or inefficient operations. In many instances, a less expensive optical module may have a shorter warranty or experience failure at a higher rate, which can be expensive after factoring in the costs of replacing the item or lost service time as you find replacement modules.

It is important to think about the costs of ownership over time, such as support and maintenance, as well as any service issues caused by the failed module. For example, the sticker price on a car does not show the costs of fuel, repairs, or insurance, which all add up over time.

Mistake 3: Purchasing the Most Inexpensive Modules Without Research

All vendors will try to drive the cost of products down, but it is important to always be sure to research the products you are purchasing. A vendor could have a price war and price modules very low. Seeing this, some buyers purchase without confirming if it is a product they can trust.

If a vendor can offer a low price, the assumption is they have invested in independent lab tests, a credible warranty, or client references. The bottom line you should remember is cheaper will not always equal better value. Your best course of action is to:

- Use vendor compatibility matrices before you buy

- Calculate TCO including warranty and failure rates

- Perform validation tests for performance when you can

- Take the time to find vendors that can provide strong technical support and transparency around their policies.

Future-Proofing Your Procurement Strategy

The Impact of Upcoming Technologies on Pricing

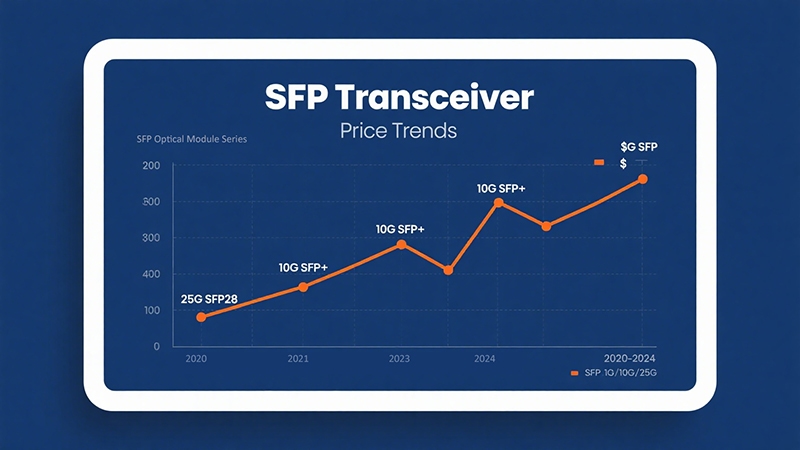

The launch of high-speed optical modules like 25G, 40G, and 100G is transforming pricing for legacy SFP (1G and 10G) modules. As network infrastructures continue upgrading to support increased bandwidth usage, production volumes for older-generation modules shrink, leading to price volatility.

Obsolescence trends are driving prices downward as manufacturers’ priorities shift from old legacy technologies to newer technologies, leading to possible short-term scarcity of legacy inventory. This situation is similar to a generational shift in electronics; older technology gains collector value or becomes increasingly scarce when technology changes. As new standards bring new materials and integrated circuit designs, as well as better performance, prices will initially increase. As they become commonplace and produced in higher volumes, prices will decline. Recognizing this adoption curve assists with procurement timing.

Anticipating Future Price Trends

Monitoring market signals like semiconductor supply chains, vendor capacity expansion, and macroeconomic indicators can provide early insight into price trends. Analysts anticipate that newer high-speed modules will represent the vast majority of new purchases, while legacy modules will still have demand in certain applications, leading to highly variable prices.

Higher price volatility can be reduced by maintaining a procurement plan to balance current needs with growth in demand. Staying current on any developments affecting supply on the vendor side can greatly reduce the reliance on emergency purchases at inflated prices.

Final Checklist for Your Next Purchase

Purchasing an optical module requires considerable consideration around a number of key factors. Use the following checklist to simplify the process of systematically evaluating these factors:

- Technical Compatibility: Validate all interface types match the appropriate data rate and protocol to make sure no mismatched or overpriced module is inadvertently purchased.

- Vendor Reputation: Buy only from reputable vendors that are known for producing reliable products, have long track records for quality and service, and have established reputations for responding to customer service needs.

- Warranty and Support: Ensure sufficient and fully covered warranties exist on the product or, even better, from the vendor. This consideration can help eliminate future perceived downtime risk.

- TCO: In addition to assessing the initial purchase price, consider factors like maintenance, replacement, and power consumption when quantifying the pricing of optical modules.

- Performance Testing: Always review third-party vendor testing data on optical module performance in addition to in-house testing to confirm optical modules meet specifications.

- Scalability / Future Proofing: Pick optical modules designed for functionality that supports upgrades and multi-speed operations based on your projected growth.

- Supply Chain Reliability: Evaluate vendor stock and delivery reliability to minimize any project delays.

- Regulatory Compliance: Ensure that you are following industry best practices, standards, and legal requirements whenever possible.

Conclusion

What is intelligent procurement? It is much more than trying to find the lowest price. Intelligent procurement is proactive and balanced. Above all else, however, it requires a strategy of balancing quality, vendor support, and currently established network requirements while taking long-term network requirements into consideration.

Purchasing an optical module means balancing the upfront price with whatever reliability exists should the module fail or require replacement. A focus on price can lead to undue stress on the reliability of your network. By developing an understanding of price trends, being critical about vendor selection, and considering the best purchasing practices, organizations can approach spending with the goal of value and service level certainty, while not jeopardizing overall network performance.

A well-thought-out procurement process protects your investment in infrastructure and allows for a seamless, scalable approach for growth. Think of procurement as the foundation of buildings: the right materials and craftsmanship offer a foundation for future success and durability. Working empirically from the ground up will provide the confidence to make well-informed decisions. Equip yourself with best practices by adopting a unique viewpoint into the market. The three aspects of demystifying market dynamics will provide additional confidence in creating robust and sustainable networks to minimize or eliminate issues both now and in the future.

Reference Sources

- Wikipedia – Optical Module Overview: Neutral background on optical module definitions and standards.

- Juniper Networks – Official Transceiver Catalog: Juniper’s official transceiver and optics product catalog for supported hardware and requirements.

- Arista Networks – Data Sheet for Optics & Modules: Datasheet outlining Arista’s transceiver models and technical specs.

A Strategic Guide to Optimizing Your Optical Module Spend

A Strategic Guide to Optimizing Your Optical Module Spend